HSC/SAC finder for ONDC Network sellers

Find the right code, right now. Simplify your ONDC Network listings with accurate HSN/SAC codes. Search, find, and stay compliant.

Search Results:

| Description | HSN Code |

|---|---|

No Results Found |

|

The HSN/SAC code or keyword you entered is not on record or is invalid.

What are HSN codes?

Harmonized System of Nomenclature (HSN) codes are standardised numerical codes used to classify goods in international trade. These codes help identify products for customs duties, taxes, and trade regulations.

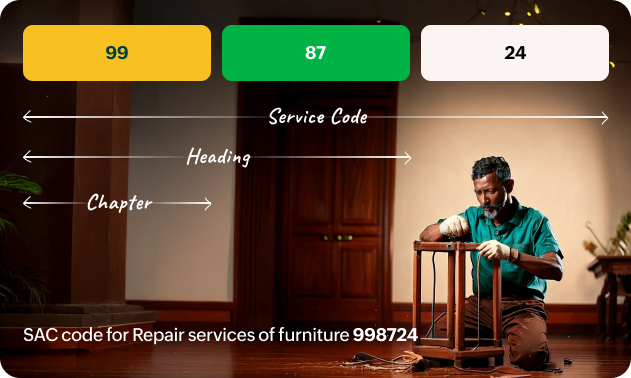

What are SAC codes?

Services Accounting Codes (SAC) are used to classify services under the Goods and Services Tax (GST) framework in India. These codes help identify the nature of services for tax purposes, ensuring proper classification and compliance.